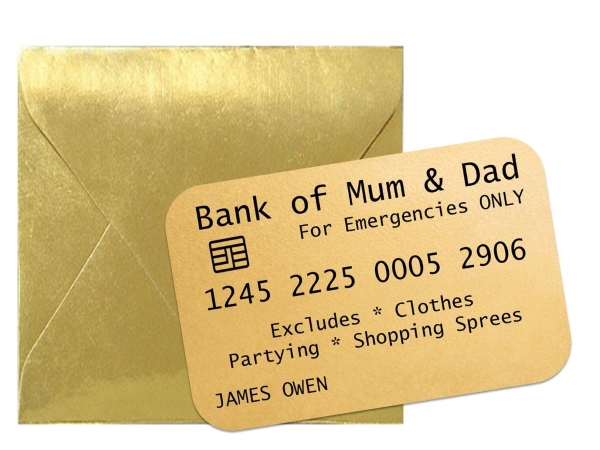

The cost of going to university has only spiralled in recent years. Although student loans are only repayable once the student has graduated and is earning over a certain amount, in the immediate term students need to eat, clothe themselves and pay rent and utilities. Many feel the maintenance loan is not enough and it’s based on household income. This means an expected level of subsidy from parents. In a recent report, the full price of parental subsidy has been revealed.

£138.50: The Average Contribution of Bank of Mum and Dad

Around 50% of students in the annual Save The Student Survey say they felt their parents’ finances were limiting and felt disadvantaged regarding the cost of going to university. This is based on changes to the Maintenance Loans. The overwhelming majority of students were in receipt of money from their parents. Around a third felt their parents did not (and could not) provide enough money to find the cost of their education while the average figure came out at £138.50 per month.

Surprisingly, it was discovered that poorer parents overcontribute based on government expectation. Households whose total income per year is less than £25k are not asked to contribute but do so at a rate of £54 per month.

The Maintenance Loan in Brief

It was introduced to cover the cost of living while studying at university. How much you receive depends on your household income (typically your parents). Children of higher-earning parents are entitled to less money in loans on the expectation that your household earners can afford to pay more towards your cost of living. Of course, that also means lower-earning households are entitled to more money in loans.

As mentioned above, the lowest earning are not expected to pay anything towards the cost of their child’s education but do so at a rate of approximately £54 per month (which is an overpay on the expected rate of £54 per month). Households earning more than £60k underpay by £60 per month (they are expected by calculations to pay £353 but pay £193).

Money Worries

Regardless of household income, most students worry about money – a massive 78%. Many are learning to budget properly for the first time and feel that there is little correlation between the high tuition fees, high interest (although this is linked to inflation) and low relative value of the loan. However, it must be pointed out that students will only pay back their loans when they earn over a certain salary. In most students’ cases, this will be written off after a certain period – usually 25 years. Most concerning for the survey is that 27% feel that money worries had a direct impact on their educational performance.